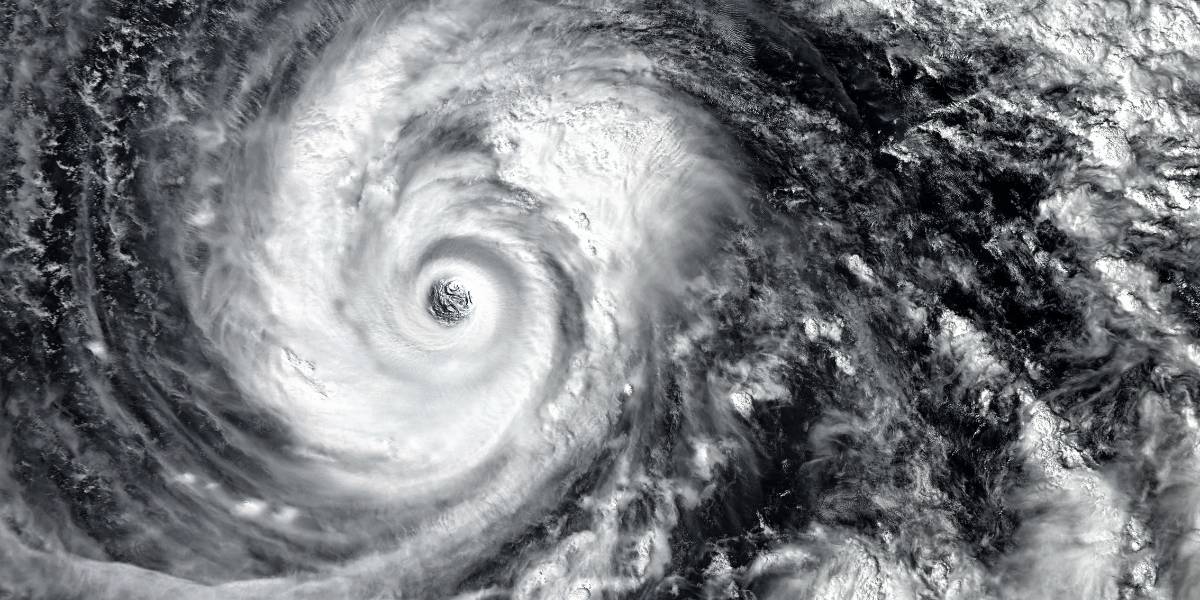

Hurricane Ian was one of the most devastating hurricanes to hit the southeastern United States in recent history, leaving behind a trail of destruction. The aftermath property damage was immense, affecting countless homes, businesses, and communities. Understanding the extent of this damage and navigating the complexities of insurance claims is crucial for those impacted by the storm. This blog will provide insights into the types of property damage caused by Hurricane Ian and the essential aftermath insurance services available to help you recover and rebuild.

The Impact of Hurricane Ian

Hurricane Ian made landfall with powerful winds, torrential rain, and severe flooding. The sheer force of the storm caused widespread destruction, leaving many to deal with significant aftermath property damage. Here are some of the most common types of property damage observed:

1. Wind Damage

The high winds of Hurricane Ian tore through buildings, uprooted trees, and caused extensive damage to roofs, windows, and walls. Many structures were left vulnerable to further damage due to compromised roofing and broken windows.

2. Flood Damage

Flooding is often one of the most devastating consequences of a hurricane. Hurricane Ian brought massive storm surges and heavy rainfall, leading to extensive water damage in homes and businesses. Floodwaters can ruin foundations, electrical systems, and personal belongings, causing long-term issues if not addressed promptly.

3. Structural Damage

The combined effects of wind and water can lead to significant structural damage. This includes weakened foundations, collapsed walls, and destabilized buildings. Such damage often requires comprehensive repairs to ensure the safety and integrity of the structures.

4. Mold and Mildew

In the wake of flooding, mold and mildew can quickly become a problem. These fungi thrive in damp environments and can spread rapidly, causing health issues and further property damage. Addressing mold growth promptly is essential to prevent long-term consequences.

Navigating Aftermath Property Damage

Dealing with the aftermath property damage caused by Hurricane Ian can be overwhelming. It is essential to take immediate steps to assess and document the damage, make necessary repairs, and navigate the insurance claims process.

Assessment and Documentation

- Safety First: Ensure the property is safe to enter. Check for structural damage, electrical hazards, and other safety concerns before conducting an assessment.

- Document the Damage: Take detailed photographs and videos of all damage. This documentation will be crucial for insurance claims and potential legal actions.

- Inventory Losses: Make a comprehensive list of all damaged items, including their value and condition before the storm. This inventory will help in the insurance claims process.

Emergency Repairs

- Temporary Fixes: Make temporary repairs to prevent further damage, such as covering broken windows and tarping damaged roofs. Keep receipts for any materials purchased for these repairs.

- Professional Help: Hire licensed professionals for significant repairs. Ensure they provide detailed estimates and reports, which will be useful for insurance claims.

Aftermath Insurance Services

Navigating the insurance claims process can be complex and time-consuming, especially when dealing with extensive aftermath property damage. Aftermath insurance services play a crucial role in helping you manage this process efficiently and effectively.

Understanding Your Policy

- Policy Review: Carefully review your insurance policy to understand your coverage, exclusions, and the claims process. Pay attention to details regarding flood insurance, which is often separate from standard homeowner’s policies.

- Consultation: Seek professional advice if you are unsure about any aspect of your policy. Insurance experts and legal professionals can provide valuable insights and guidance.

Filing a Claim

- Prompt Reporting: Report the damage to your insurance company as soon as possible. Provide them with the documentation and inventory you have prepared.

- Detailed Claims: Submit a detailed claim, including all necessary documentation, estimates, and receipts. Be thorough in your descriptions to ensure all damage is accounted for.

- Follow-Up: Stay in contact with your insurance company and follow up regularly on the status of your claim. Keep records of all communications.

Disputes and Denials

- Challenges: Insurance companies may dispute claims or deny coverage. In such cases, it is essential to understand your rights and options.

- Legal Support: If you face disputes or denials, seeking legal representation can make a significant difference. Experienced attorneys can help you navigate the appeals process and ensure you receive the compensation you deserve.

Clayton Trial Lawyers: Your Advocate in Aftermath Property Damage Cases

At Clayton Trial Lawyers, we understand the challenges and complexities of dealing with aftermath property damage. Our team of elite attorneys specializes in insurance law and personal injury cases, providing you with the expertise and support needed to navigate this difficult time.

Why Choose Clayton Trial Lawyers?

- Expertise and Experience: Our attorneys come from prestigious backgrounds, having represented large corporations and billionaires. We bring the same level of dedication and skill to every case, no matter the opponent.

- Compassion and Commitment: We are committed to fighting for you with compassion and courage. We understand the challenges you face and will do whatever it takes to protect your rights.

- Relentless Advocacy: Our mission is to right wrongs in personal injury cases. We are relentless in our pursuit of justice for our clients, ensuring that you receive the maximum compensation possible.

Conclusion

The aftermath property damage caused by Hurricane Ian is extensive and challenging to navigate. Understanding the types of damage, taking immediate steps to assess and document losses, and utilizing aftermath insurance services are crucial for recovery. If you find yourself facing disputes or denials in your insurance claims, Clayton Trial Lawyers is here to help. Our experienced team will fight tirelessly to ensure you receive the compensation you deserve, allowing you to rebuild and move forward with confidence. Remember, in personal injury cases, we don’t win unless you do. Let us be your advocates in this difficult time.