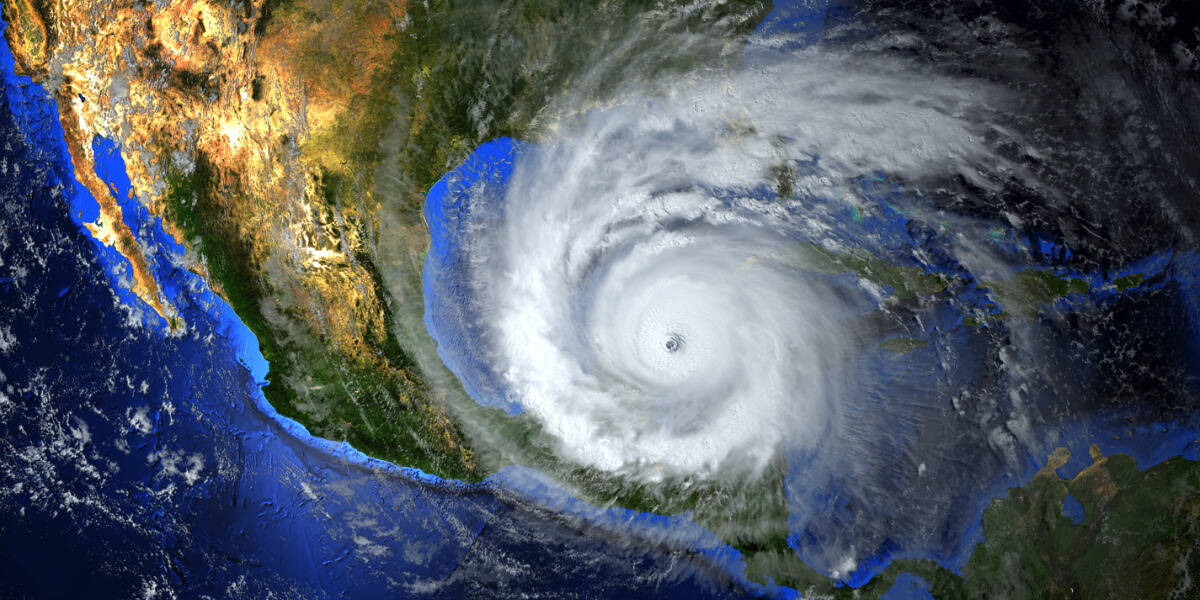

When the skies darken and the winds pick up, preparation can be the difference between devastation and security. For those living in storm-prone areas, learning how to prepare for hurricane involves more than just boarding up windows and stocking up on supplies. It also requires a solid understanding of the legal protections and obligations that come into play before, during, and after a storm. This blog will explore the essential emergency preparation and legal steps you need to consider to safeguard your home, family, and finances against the fury of nature. From insurance claims to federal aid, we’ll provide you with the legal knowledge you need to weather any storm with confidence.

When is Hurricane Season in Florida?

Hurricane season in Florida runs from June 1st to November 30th, encompassing a broad range of the year when tropical cyclones are most likely to form in the Atlantic. This period demands heightened vigilance from residents and visitors alike. The peak of the season typically occurs from August through October when the waters of the Atlantic are warmest, providing ideal conditions for hurricanes to develop and intensify.

Legal professionals and insurance companies particularly emphasize the importance of preparation during these months, as the frequency and intensity of storms can lead to significant legal and property claims. Understanding this seasonal window is crucial for implementing timely preventative measures and ensuring that all legal and insurance matters are handled proactively before the threat of a storm.

How to Prepare for Hurricane: Maximizing Preparedness

Effectively knowing how to prepare for storms or hurricanes is crucial to minimizing damage and ensuring safety before, during, and after the storm. Here are the essential steps to consider:

1. Understand the Risks:

Assess the specific risks associated with your location. Coastal areas may face higher risks of flooding and storm surges, while inland regions could contend with high winds and torrential rains. For instance, the National Weather Service and local government websites provide hazard maps that are invaluable in understanding your area’s vulnerabilities. These maps help in identifying flood-prone areas and are crucial for planning evacuation routes.

2. Create an Emergency Plan:

Your emergency plan should include evacuation routes, emergency shelters, and a communication plan for your family. It’s essential to discuss and practice this plan with all family members. According to the Federal Emergency Management Agency (FEMA), local emergency management agencies offer resources and guidelines to help in crafting a comprehensive approach, ensuring that everyone knows what to do and where to go when warnings are issued.

3. Prepare Your Home:

Securing your home is a key step in storm preparation. This includes reinforcing roofs, windows, and doors. As recommended by the Department of Homeland Security, one tip on how to prepare for hurricanes is clearing gutters and downspouts to prevent water buildup and trimming trees to reduce the risk of falling limbs. The more you can proactively prepare for disasters, the more you can safeguard your property against some damages from natural disasters that would’ve been worse otherwise.

4. Emergency Supplies:

Stock up on essential supplies, including:

- Non-perishable food and water for several days

- Batteries, flashlights, and a battery-operated radio

- First aid kit, medications, and personal hygiene items

- Portable chargers for electronic devices

The Red Cross suggests keeping these items ready in a go-bag in case of sudden evacuations.

5. Important Documents:

Keep important documents such as insurance policies, identification documents, and legal papers in a waterproof container. Additionally, have copies of these documents in a secure, easily accessible digital format. This step is critical for quick access to documents needed for filing insurance claims or applying for federal aid.

6. Insurance Review:

Well before a storm hits, review your insurance policies. Understand what is covered and what is not. For example, flood damage is not typically covered under standard homeowner’s insurance policies and requires separate coverage, as stated by the Insurance Information Institute.

Insurance and Legal Tips for Post-Storm Recovery:

Here are essential insurance and legal tips to navigate the post-storm recovery process effectively, ensuring you secure the compensation and support you need.

1. Document Everything:

After the storm, document all damages with thorough photographic evidence. This documentation is crucial for insurance claims and any legal actions. Photograph all angles of the damage and include date stamps on pictures to provide a timeline that supports your claim.

2. Immediate Notification:

Notify your insurance company immediately after the event to start the claims process. Delays in notification can complicate claim processing and potentially delay necessary payouts.

3. Beware of Quick Fixes:

One wrong way on how to prepare for storms and hurricanes is opting for cheap solutions. Be cautious of contractors soliciting quick, cheap repairs. Unscrupulous contractors can take advantage of distressed homeowners. Always verify the credentials and reputation of any contractors you engage, as recommended by consumer protection agencies.

4. Legal Consultation:

In some cases, you might need legal advice regarding claims, especially in complex cases such as those involving significant property damage or injury. This is particularly pertinent in situations leading to potential lawsuits, like exposure to contaminated water in military bases.

Utilizing Local and Government Resources

1. Local Resources

Local governments and emergency services play a pivotal role in providing support and disseminating information both during and after hurricanes. Their websites are a vital resource for obtaining real-time updates about storm paths, safety warnings, and evacuation orders.

Additionally, these sites list emergency contacts, including numbers for disaster relief services and local shelters. They also offer detailed recovery services, such as where to find help for debris removal and how to apply for local aid. Engaging with these resources ensures that residents have access to the most current and relevant information, facilitating a more organized and safe response to hurricane impacts.

2. Federal Assistance

For more extensive disasters, federal assistance becomes a crucial lifeline for affected communities. Agencies like the Federal Emergency Management Agency (FEMA) provide financial aid that can be critical for families struggling in the aftermath of a storm. This assistance often covers expenses not typically accounted for by insurance, such as temporary housing and essential home repairs.

Additionally, FEMA offers grants that do not require repayment, providing funds for home repairs to fix damage not covered by insurance and to ensure homes are safe, sanitary, and functional. Understanding how to access these services promptly can significantly ease the financial burden on affected households.

3. Health and Safety

The aftermath of a hurricane can create serious public health risks, from contaminated water supplies to disrupted healthcare services. Local health departments are instrumental in alerting the public to health advisories, such as boiling water notices or the availability of medical aid stations. These departments work closely with federal health agencies like the Centers for Disease Control and Prevention (CDC) to monitor and address emerging health threats. By staying informed through these official channels, residents can take appropriate measures to protect their health against contaminants and ensure they have access to necessary medical services during a critical time.

How to Prepare for Storms and Hurricanes with Legal Support:

Insurance is vital for protecting your home’s value and recovery during a storm, however, it’s possible that issues can arise when filing insurance claims or receiving financial assistance. Here are examples of how a lawyer can help you and your home receive the benefits, support, and justice you deserve:

- Flood damage claims: Homeowners’ insurance typically does not cover flood damage, so a separate flood insurance policy is required.

- Wind and wind-driven rain damage claims: Homeowners insurance covers damage from wind and wind-driven rain, but policies may have separate, higher deductibles for hurricane/windstorm damage.

- Disputes over underpaid or denied insurance claims: Policyholders may need legal representation if they feel the insurance settlement offer is inadequate or their claim is unfairly denied.

- Assistance with documentation and claims filing process: Law firms can guide policyholders on properly documenting damages and navigating the complex claims filing procedures.

- Advice on insurance policy coverage and requirements: Law firms can review policies to ensure policyholders understand their coverage limits and obligations.

The search results indicate that working with an experienced law firm can be crucial for policyholders to successfully navigate the insurance claims process and receive the full compensation they are entitled to after a natural disaster or hurricane.

Get Help From Clayton Trial Lawyers

Preparing for hurricanes and severe storms extends beyond just securing physical belongings. It involves a comprehensive approach to ensure your legal rights and financial interests are also safeguarded. By taking the necessary steps before and after a storm, you can protect yourself from additional stress and potential legal complications. Should you need legal assistance, especially concerning specific issues regarding legal advice after hurricanes and natural disasters, please reach out to our trusted team of professionals who will support you every step of the way.

The information provided in this article is for educational purposes only and does not constitute legal advice. For specific legal advice, please consult with a qualified attorney.

FAQs

Q: What is the first thing I should do after a hurricane if I suspect my property is damaged?

A: Document all damage with detailed photographs before starting any cleanup or repairs. This documentation is essential for insurance claims and potential legal actions.

Q: What should I be aware of when hiring contractors after a storm?

A: Verify the contractor’s credentials and check for a history of complaints. Be skeptical of those offering services at significantly lower prices or demanding upfront payment. Always ensure contracts are reviewed before signing.

Q: How can I prepare my home to withstand a hurricane?

A: Reinforce roofs, windows, and doors. Secure or bring inside any loose items from outside your home. Ensure your gutters and drainage systems are clear to handle heavy rains.

Q: Why is it important to review my insurance policies before hurricane season?

A: Reviewing your insurance policies helps ensure that you have adequate coverage for damages not typically covered by standard policies, such as flood damage.

Disclaimer: This article is for educational purposes only and is not intended to provide legal advice. Contact our experienced legal team for direct legal guidance and support.